The Great Fintech Detox

India's digital finance story is no longer about disruption — it's about survival, margins, and owning something real.

Indian fintech is going through its “wake up, grow up, show up” phase.

Gone are the days when just throwing in words like "disruption", “neo-bank”, and “user-first” got you fat valuations. Now the music's stopped. IPOs are here. VCs want exits. Markets want math. And guess what? Most of the fintechs don't have the numbers. What they have are app downloads, glitzy UIs, and zero cash flow.

The Valuation Hangover – Welcome to Reality

When capital was free, every fintech was a unicorn. ZIRP (Zero Interest Rate Policy) era made money so cheap that anything with a graph and buzzwords got $100M. No one asked tough questions. “Will you ever make money?” was an insult back then.

But now? The correction is real.

IPOs are exposing everything. Paytm crashed. PolicyBazaar flatlined. Mobikwik? Ghosted.

They were priced as tech stocks, but got judged as financial services. That’s a death sentence for dreams.

Now, public market says: “Don’t show me DAUs. Show me EBITDA.”

Between the lines?

VCs who overpaid want exits, but they’re stuck. IPO window’s tight. Next round funding? Drying up. They’re stuck between "raise again" and "go public under water". Either way - it’s a haircut season.

The UPI Trap – Infra is Free, But You're Paying the Cost

UPI is both the pride and poison of Indian fintech. It made payments frictionless, democratic, and… totally unmonetizable.

Let’s be honest. UPI is a zero revenue zone.

No MDR (Merchant Discount Rate) = No earnings from payments.

Everyone – PhonePe, GPay, Paytm – became a dumb pipe. NPCI runs the show. You’re just a user interface on top of infra you don’t control.

You’re giving Indians dopamine hits of instant money transfer. But making zero money.

Blur area?

Most fintech apps are desperately trying to sell credit cards, mutual funds, or insurance to survive. Payments are just bait. It’s not a business. It’s a hook.

And you can’t even tweak the experience too much — UPI is regulated to the bone. NPCI decides who gets how much traffic, not you.

Not All Fintechs Are Equal – The Four-Type Framework

The market has silently sorted fintechs into four buckets. But no one’s saying this loudly. Here's how they’re being judged:

Only the infra layer players (like M2P, Setu) are smiling quietly. They’re not sexy, but they’re needed. They’re infra that powers others — like the AWS of fintech. Nobody tweets about them, but everybody pays them.

Neo-banks like Jupiter are just pretty apps sitting on top of banking partners. If the bank partner dies or RBI changes rules? You’re finished.

WealthTech’s Secret Salt – The Rich Are the New TAM

The first wave was Zerodha, Groww — “let’s bring retail into investing.” That worked.

Now? Next wave is elite.

It’s about consolidated net-worth management.

Not just mutual funds, but PMS, AIFs, FDs, gold, real estate, even crypto — everything in one place.

And serving niche TGs (target groups): doctors, NRI kids, startup bros, senior citizens with large FDs.

Hidden Insight?

Wealth tech is quietly moving away from mass India to upper 3 crore Indians who want full-stack digital advisors — not just apps. Think “family office for upper-middle class”.

This also explains why platforms are focusing more on "relationship managers in a dashboard" and less on DIY trading.

The Real Metric Shift – From User Growth to Margin Growth

Here’s the harsh truth — no one cares how many users you have now.

What matters is: how many of them pay? Stay? And are worth cross-selling to?

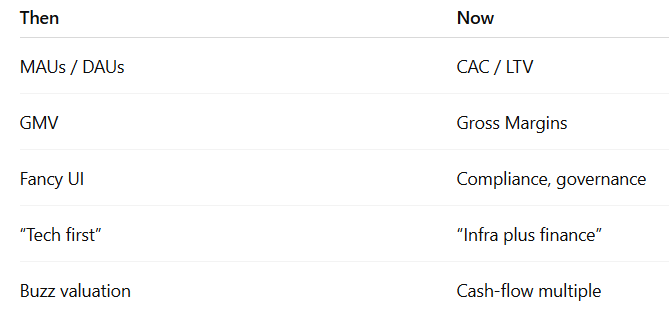

The market has shifted from

It’s like your fintech is being downgraded from being a Tesla to being a Maruti Suzuki. Reliable? Yes. Disruptive? No. That’s the mood now.

Every founder is now in boardrooms saying:

“How do we cross-sell lending?”

“Can we bundle insurance?”

“Should we buy infra guys and look like a platform?”

Why This All Feels So Heavy

Because the narrative has shifted:

From “Fintech will kill banks”

→ to “Fintech needs banks”

→ to “Banks now look like tech companies too”

This is an ego reset. Founders who raised like tech giants are being treated like NBFC operators now. And public markets are brutal in this shift.

What Survives?

Only those who get 3 things right:

Infra control – Not just UX.

Data loop – The ability to underwrite, personalize, cross-sell.

Regulatory fitness – India is not USA. RBI is the boss here.

(But Dirty)

UPI killed margins, now everyone’s broke.

Public market killed hype, now everyone’s humble.

Real value is in infra + lending + niche wealth, not payments.

Fintechs are being detoxed from VC steroids. And it’s painful.

The future? Quiet, boring infra companies who print cash.

MIND MAP

INFRASTRUCTRE IS NOW NEW AESTHETIC

NOTICE - Use AI for some corrections