Why Is OpenAI Buying Jet Engines?

What started as a random scroll on X led to a deep rabbit hole of AI data centers, power shortages, and GE’s quiet domination.

Disclaimer: Image is just for FUN

Behind every flashy LLM or GPU cluster is an industrial giant quietly selling jet-engine-grade gas turbines.

AI data centers need huge power and I call this Backend main power component architecture of AI UNIVERSE

BACKGROUND:

OpenAI is building a huge new AI data center called Stargate in Texas.

These data centers run powerful AI like ChatGPT and need a crazy amount of electricity to work.

But the local electricity grid in that area cannot supply enough power right now.

Instead of waiting for the grid to catch up, OpenAI (through a company called Crusoe) is buying and installing gas turbines — like mini power plants.

They’ve bought 29 powerful gas turbines from GE Vernova.

Each turbine can create 34 megawatts of power.

If all 29 are used, that’s 986 megawatts — almost enough to run 500,000 powerful AI chips.

These turbines work like jet engines — they can turn on and off quickly.

They help keep the power flowing smoothly, even if the main grid is unstable.

They also use technology to reduce pollution, but they still burn gas — so it’s not clean energy.

Right now, the site has permission to use only 10 turbines.

The other 19 may:

Be waiting for government approval,

Be used at other OpenAI data centers,

Or maybe (like Elon Musk) they'll be used quietly, without full reporting (controversial!).

Elon Musk is shipping an entire power plant from overseas for his AI projects.

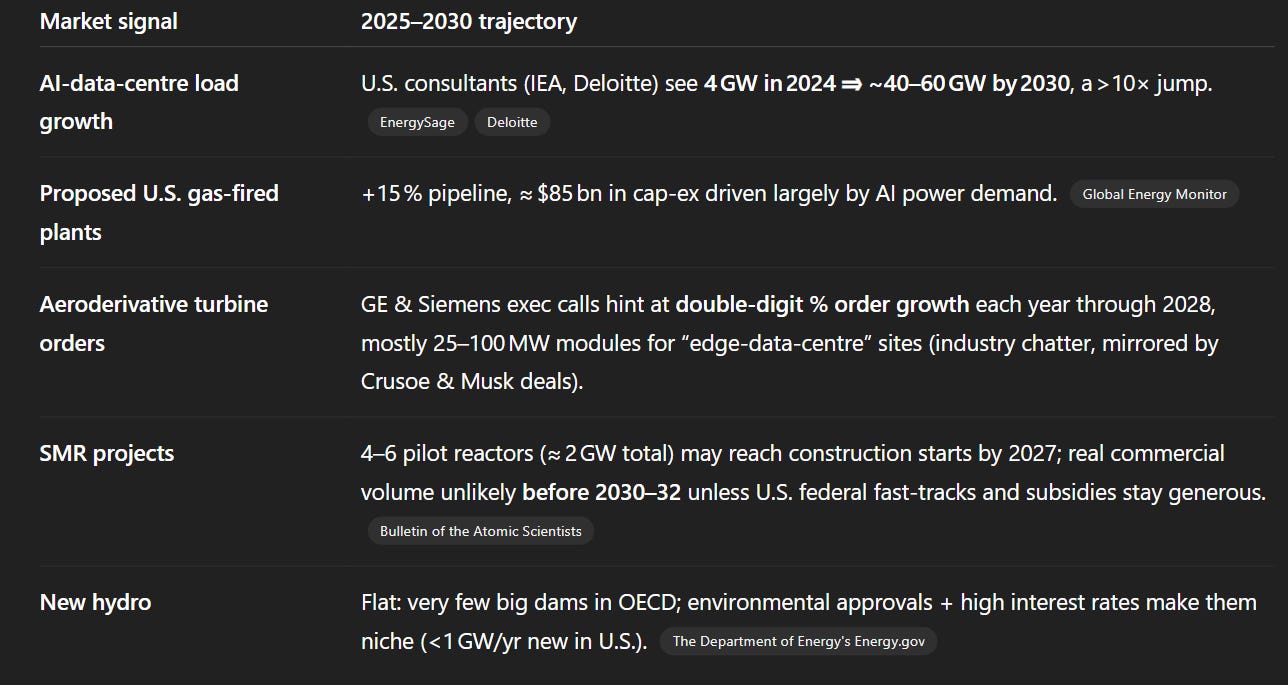

Microsoft, Meta, and Google are trying to build mini nuclear plants near their data centers.

But those nuclear reactors won’t be ready until maybe the 2030s.

How a gas‑turbine “mini‑power‑plant” works?

Air in, fuel in, fire out: a big compressor squeezes air → natural‑gas is sprayed in and burned → the hot gases spin a turbine that drives a generator.

Jet‑engine DNA: this unit is an aeroderivative turbine, literally adapted from aircraft engines, so it can start, stop and change output in minutes, not hours.

Factory‑built & plug‑and‑play: GE Vernova ships the LM2500XPRESS in container‑sized modules. OpenAI’s contractor can bolt it together and make electricity in ~14 days, with low‑NOx burners (≈ 15 ppm) and an SCR exhaust filter.

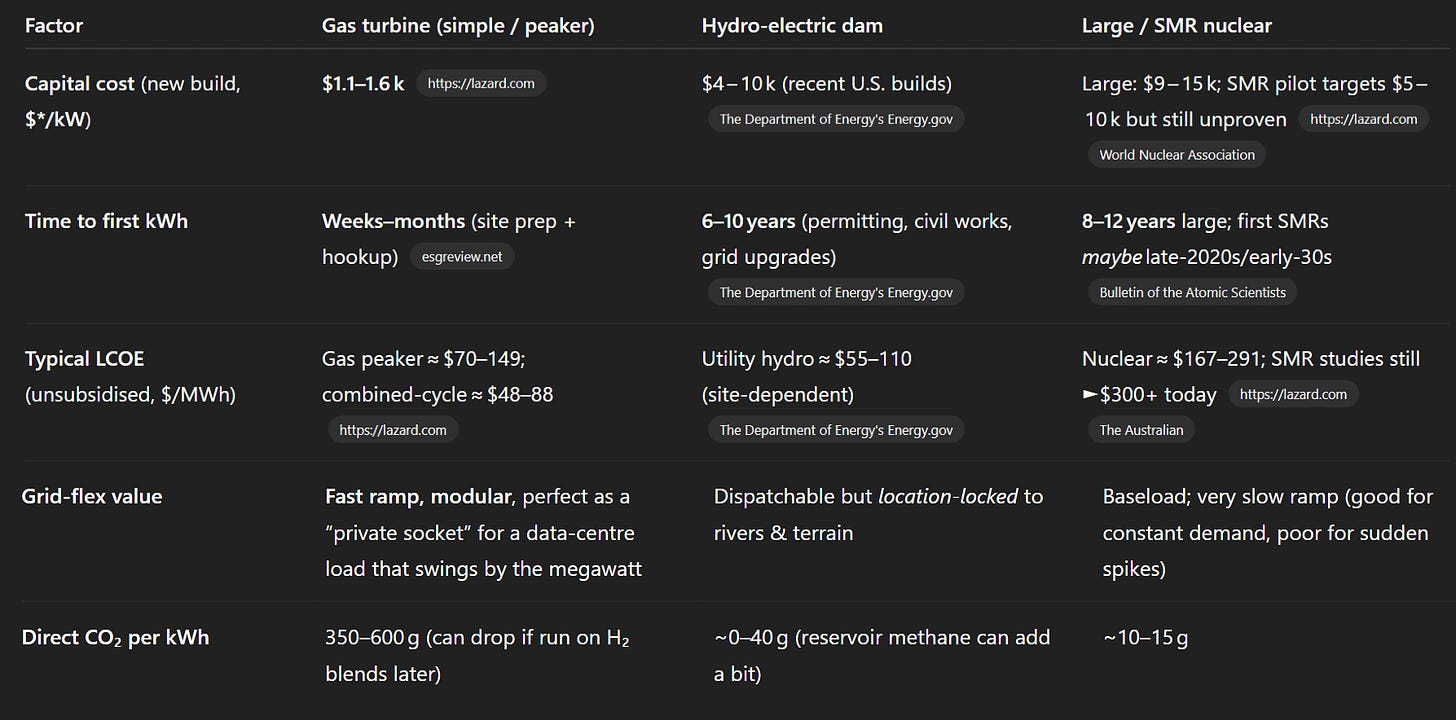

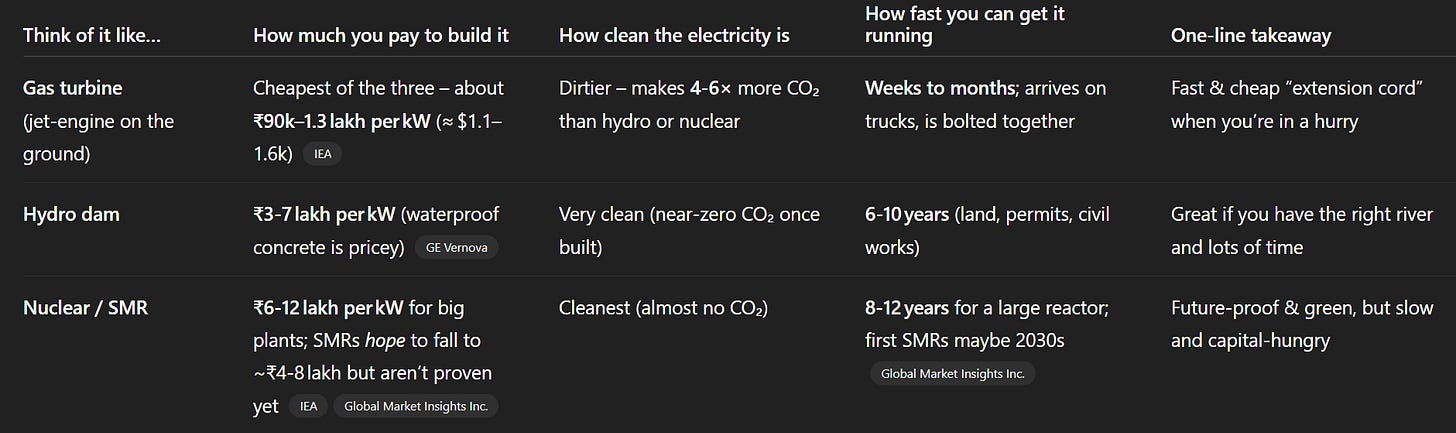

Gas turbines win on speed, siting flexibility and upfront cash, which is exactly what an AI‑compute arms‑race needs. Dams and reactors are cleaner but simply too slow and too expensive to solve a 2025‑level power crunch.

Why Not just OpenAI but everyone especially in USA picks gas turbines over dams or nuclear right now? Must read this IMAGE Line by Line

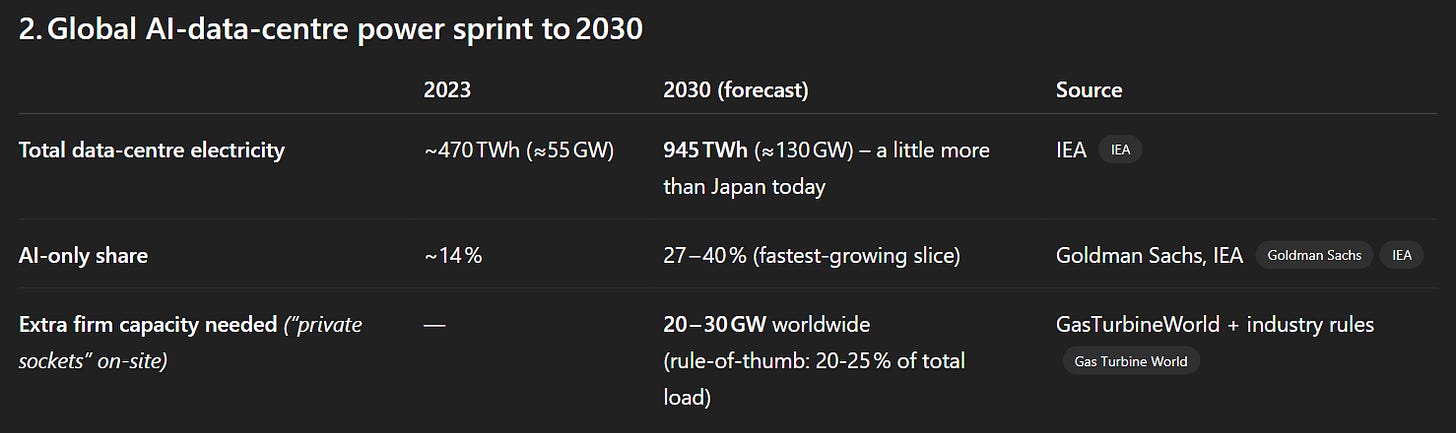

What demand looks like to 2030 (best‑guess view)

So, what’s really going on?

AI gold‑rush → power panic. Training GPT‑class models is gobbling gigawatts; grids were never sized for this spike.

“Bring your own power plant.” Instead of waiting years for a substation upgrade, hyperscalers are buying ready‑made gas units and parking them next to server halls.

Regulators & neighbours are uneasy. Gas means local air emissions; permits in Texas limit OpenAI to 10 turbines for now, hence the extra 19 units sitting in Crusoe’s warehouse.

Clean‑energy gap. Solar + wind are cheapest but not steady; nuclear is steadiest but slowest. Gas is the short‑term plug until grid storage, SMRs or hydrogen scale.

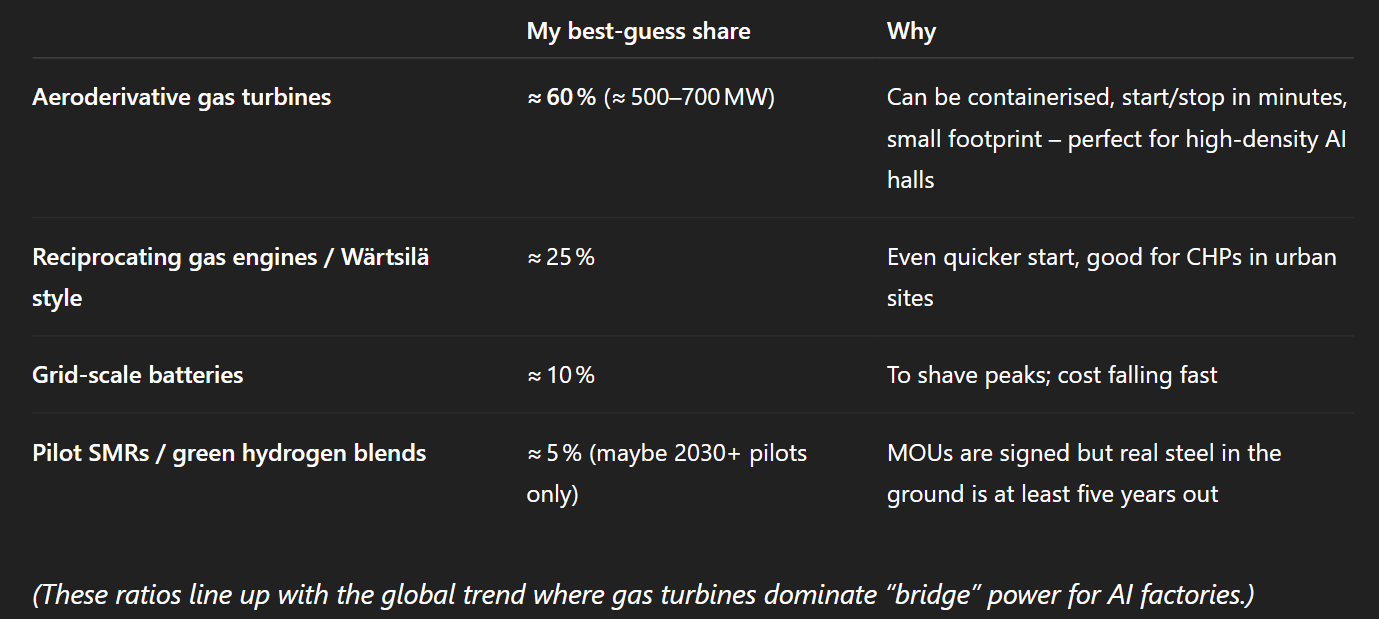

Likely technology mix

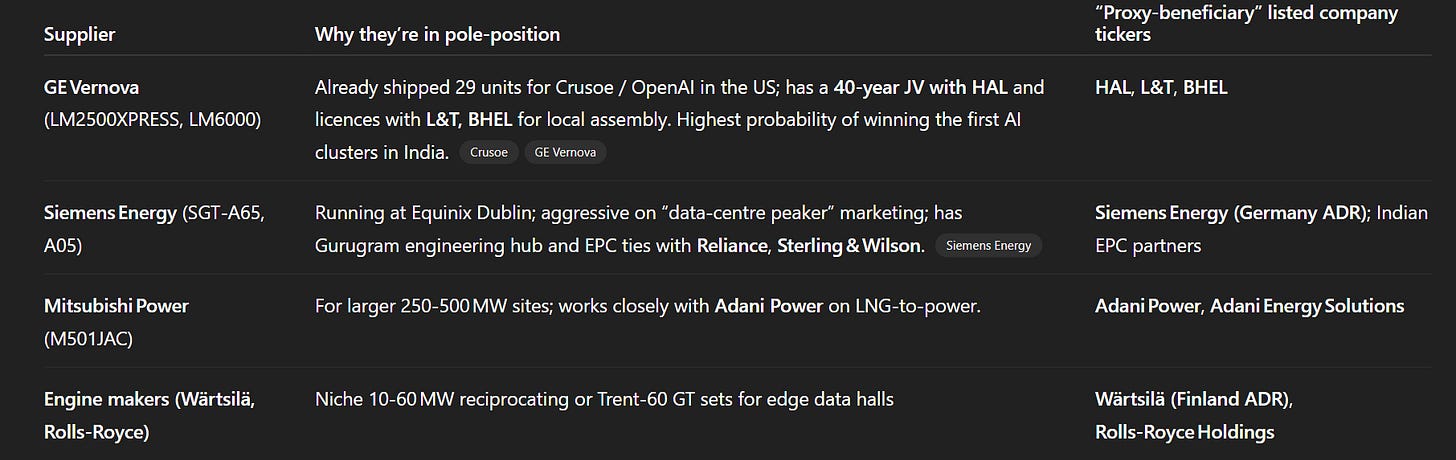

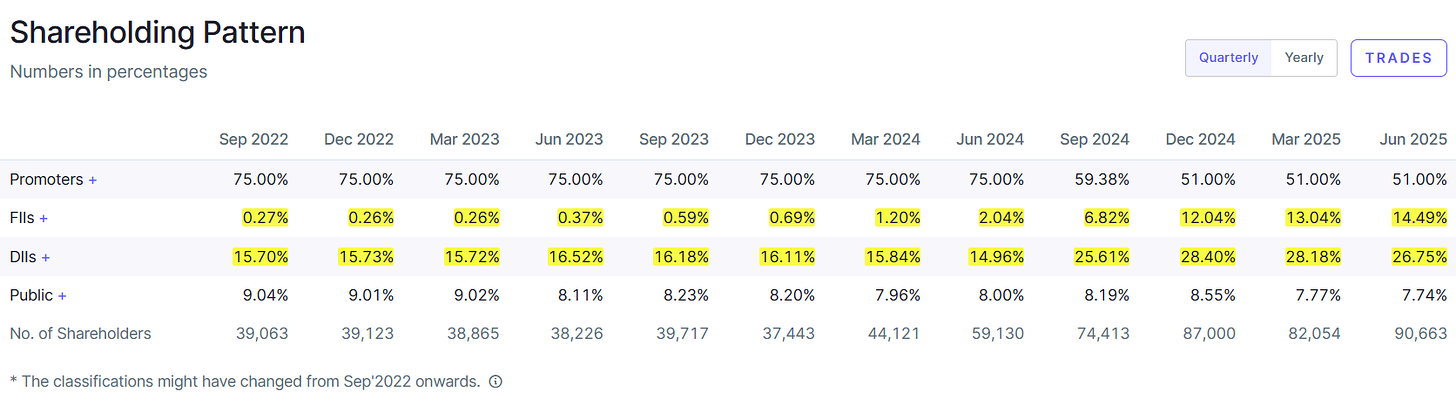

Who pockets the Indian turbine orders?

Chinese heavy‑duty turbine makers (Harbin, Shanghai Electric) are grabbing big domestic orders, but are very unlikely to supply India because of national‑security scrutiny; instead, they’ll be the winners inside China’s own AI‑park boom

GE Vernova looks like the clearest near‑term winner:

It already secured the headline AI orders (29 turbines for Crusoe/OpenAI).

It controls the LM‑series tech Indian data‑centre designers prefer, and it can localise quickly via HAL & L&T (helps it clear “Make‑in‑India” hurdles).

The company’s public spin‑off this year means its pure‑play gas‑and‑grid division’s revenue is leveraged to every incremental AI‑megawatt.

Close runners‑up: Siemens Energy (if it prices aggressively) and Indian EPC firms such as L&T, Sterling & Wilson, and Adani Power that bundle LNG supply, turbines and data centre shells into one turnkey contract.

Why so much “private power”?

Utility grids in the U.S., China, EU, India, etc. can’t build new substations fast enough. Hyperscalers are therefore parking their own power plants next to the server halls.

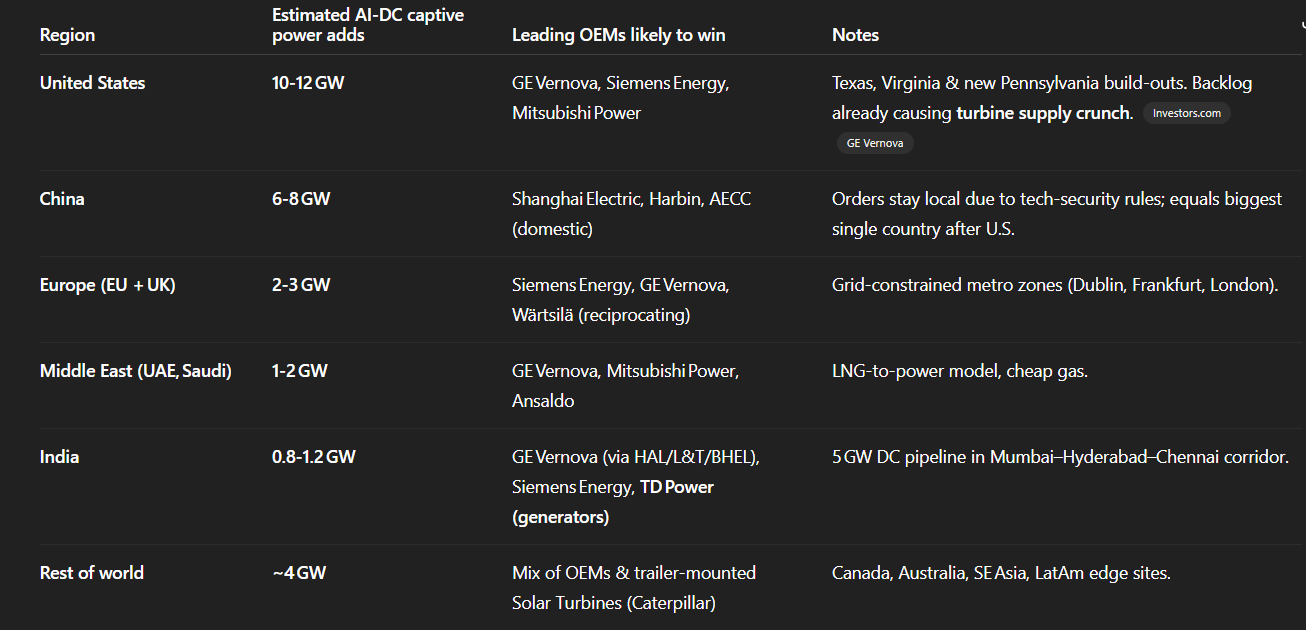

Where does the gas‑turbine order book go? (2025 → 2030)

Global total 2025‑30 orders for AI‑driven on‑site gas ≈ 25 GW (roughly 400–450 aeroderivative units at 50‑70 MW each).

This sits inside a much larger gas‑turbine market that Thunder Said Energy expects to climb from 100 GW/yr today to 140 GW in 2030.

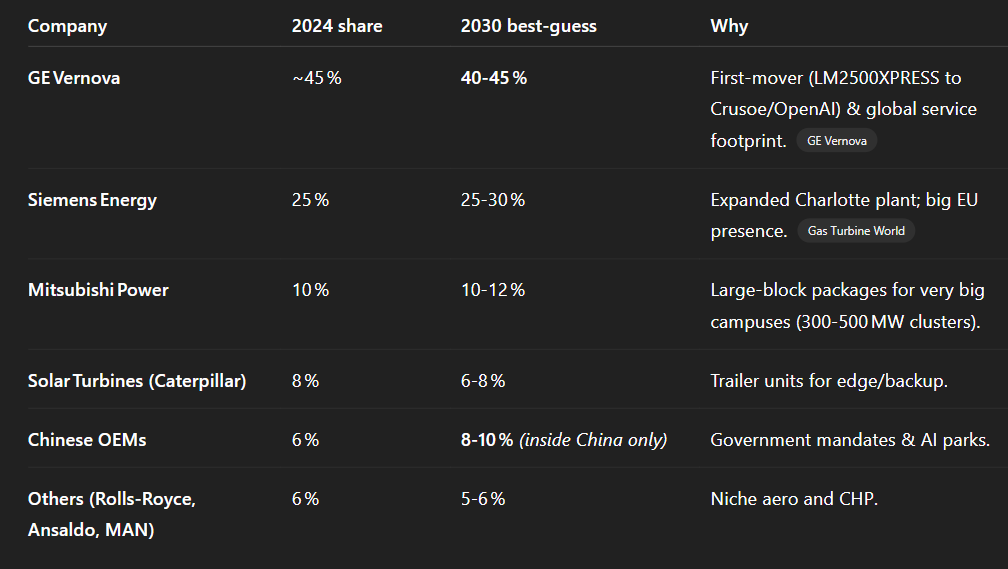

OEM market‑share outlook (aeroderivative segment)

Think of today’s AI data‑centres as giant, always‑hungry machines that eat electricity all day. The quickest and least‑expensive way to feed them right now is to park small gas‑turbine power plants—basically jet engines bolted to the ground—right beside the server halls.

By 2030, companies are likely to install around 25 gigawatts of these on‑site gas units worldwide; most will go to the United States and China, while India will order roughly one gigawatt.

The biggest winners in this gas‑turbine rush are GE Vernova, Siemens Energy, and Mitsubishi Power, with Indian generator maker TD Power Systems supplying key parts.

In India alone, data‑centre capacity is set to jump four‑fold by 2030, so operators will buy about 20–25 of these “jet‑engine” turbines over the next five years—mostly through GE Vernova’s local partners HAL, L&T, and BHEL.

Chinese turbine brands will keep booming at home, but security concerns mean Indian buyers will stick to Western suppliers.

Looking further ahead, small modular nuclear reactors or hydrogen‑fired turbines could take over after 2030.

Until then, the fastest, most practical solution for AI’s power hunger is still the trusty gas‑turbine—quick to install, relatively cheap, and ready to keep the servers humming while cleaner options catch up.

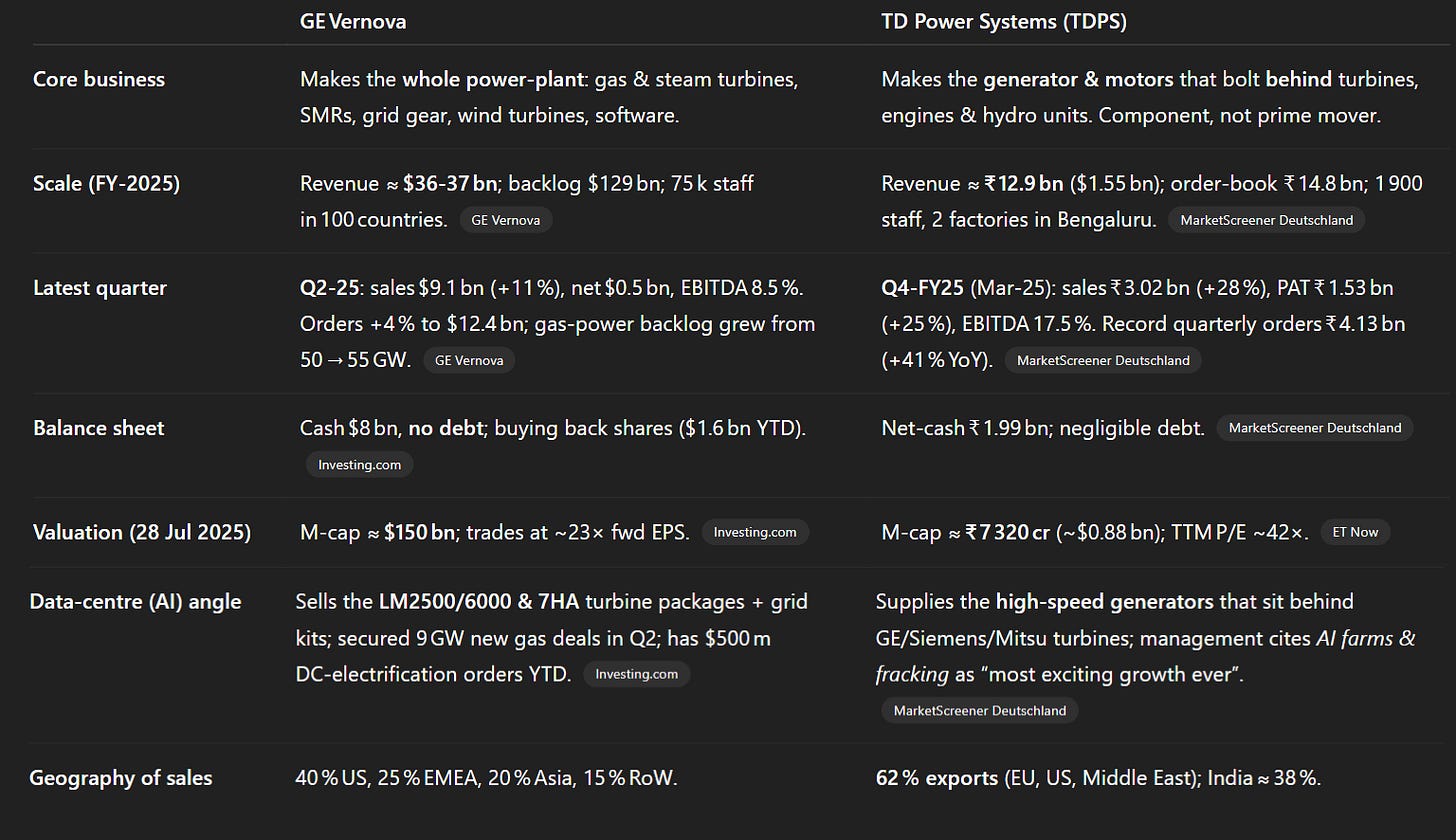

Even if yu compare with TD power, it like GE playing different game here - they build the whole cluster of AI backend power system

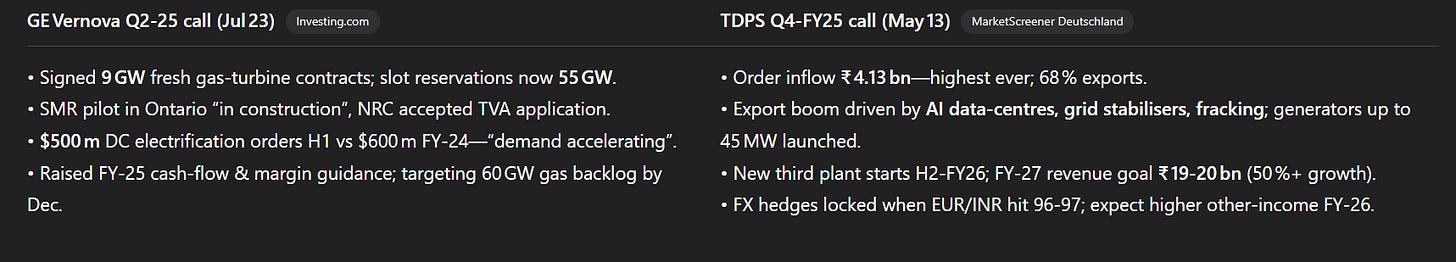

GE Vernova: capital‑heavy EPC contracts + 25‑year service deals. Margin expansion comes from price discipline & higher‑value aftermarket.

TDPS: build‑to‑spec machines (1‑250 MVA) for OEMs; cash comes up‑front, project risk sits with turbine manufacturer; gross margin driven by forex & copper prices.

What the most recent calls said

GE Vernova is the elephant— it sells the entire gas turbine and the long‑term service, owns the SMR tech, and is flush with cash. TD Power is the nimble ant— it bolts its generators onto those turbines and ships them all over the world. If the AI power boom really is “jet engines in a box”, both win, but in different ways: GE bags the multi‑billion‑dollar turbine contracts; TD Power invoices the critical spinning part inside every one of those boxes.

the blockbuster AI‑gas‑turbine boom primarily fattens GE Vernova’s global gas‑power division, not the two small GE‑branded companies you see on Indian stock screens. GE India’s listed arms can still make indirect money (grid gear, services), but they don’t build or sell the LM‑series turbines going into OpenAI, Google or Microsoft server farms.

TD Power Systems (TDPS) bolts its high‑speed generators onto the very GE/Siemens/Mitsubishi aeroderivative turbines that AI farms are buying. Management just reported record export orders, citing “AI data‑centre demand” as the driver.

Yes—the fat margins flow to GE Vernova’s U.S./European gas‑power unit.

GE India’s listed subsidiaries ride along only at the grid‑equipment fringe (GETD) or not at all (GEPIL).

If you want an Indian‑listed beneficiary of the “jet‑engines‑for‑AI” theme, TD Power Systems offers the cleanest link; GE‑branded India stocks do not.

GE Vernova T&D India - Royalty to parent jumped to ₹640 m vs ₹350 m last year – a cost that will rise with sales.

so what they are saying India Unit :

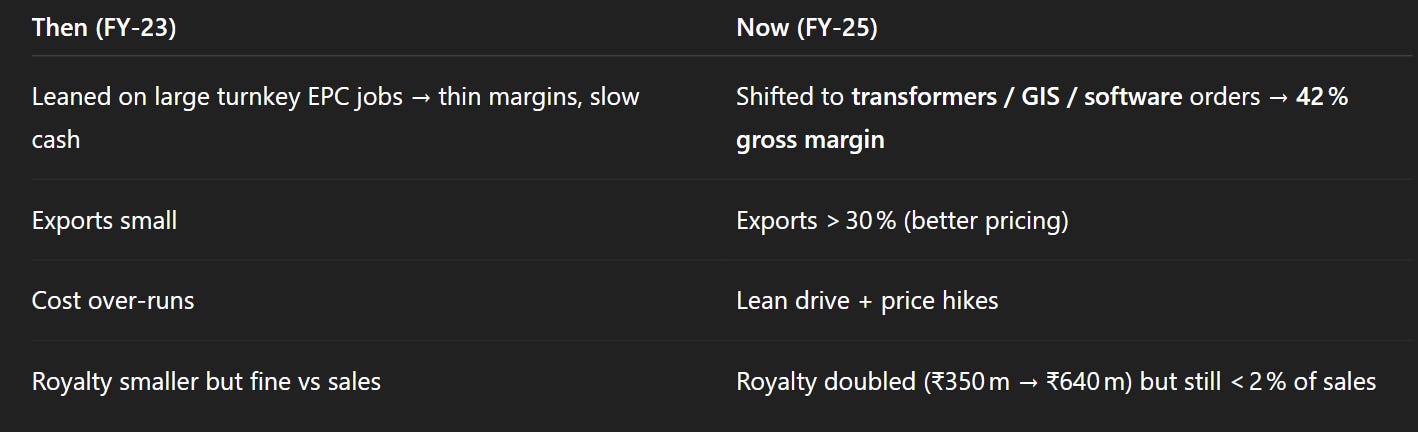

Last year was about cleaning house; this year we sold pricier gear and kept costs tight, so profits popped.

Orders are exploding – we now have two years’ work in hand.

We’re putting money into HVDC and smart‑grid tech so we can chase the next wave of projects.

Margins look sticky as long as mix stays product‑heavy and prices don’t slide.

Watch the royalty meter and supply‑chain wrinkles, but overall the company’s finally matching its talk with numbers.”

numbers jump because product mix changed, not because the market alone exploded.

Why past earnings were weak, and why they jumped now:

litigation one‑off: ₹150 m provision lifted other expenses this quarter.

Related‑party cash pool (~₹400 cr loans) briefly mentioned; needs tracking.

If India’s ₹9‑lakh‑crore grid plan and global energy‑transition spend stay on track, GE Vernova T&D India’s new HVDC line and product‑heavy mix could keep sales and high margins rolling for the next 3‑5 years — unless supply‑chain shocks or pricing cool‑offs bite first.

Past pain came from low‑margin big projects. They switched to selling high‑value equipment and exports, so profit shot up. Management sounds confident, backs it with numbers, and is adding an HVDC factory to catch the next wave. Watch royalty fees, new capex pay‑back, and whether 40 % margins stick when pricing stops rising.

MY VIEW

What I personally think is that the big opportunity is in AI as a proxy beneficiary, but GE India has very little role, and Global GE has the big role. And it feels to me like a really good opportunity because everyone needs them.

TD Power and others have potential, but they can’t build the whole ecosystem like GE can. You can watch videos on YouTube — everyone needs GE.

So I feel like this company should just be tracked closely — what they are doing now, what their future looks like. Even the India entity has some small, decent proxy potential too, and both are in my watchlist currently.

So how did I get into this and start my research? The reason is: today I read this news on X, and that really triggered me.

I personally asked myself —

“Why GE?”

“Why gas?”

“What the fuck is going on?”

“Why turbines now? Why not solar or nuclear?”

But this… this is fascinating to read — the way the AI wave and the competition is going on — from Chinese players to Grok vs OpenAI vs Meta… Everyone is being forced to find shortcuts.

And GE is the proxy for all of these shortcuts — for now.